Three different sources of information came out earlier this month all centered around rethinking one asset class in particular: emerging markets.

The first was an article written by Mohamed El-Erian, formerly of PIMCO, entitled “Rethinking Emerging Markets.” His article started by identifying three elements that typically define an asset class -

First, its components share similar characteristics: geographic location, for example, or much more importantly for investment purposes, economic and financial commonalities. These similarities allow the investments to be modeled relatively coherently for expected return, volatility and correlations with other asset classes. Yet these assets aren't so completely homogeneous that they can be replicated via a single instrument, which also opens the possibility of out-performance thanks to active management.

Second, the majority of the components of the asset class are sensitive to an external influence that is strong enough and sufficiently encompassing to have a similar impact across the board. This can take the form of a single variable, such as the price of oil for producers, or it can be linked to a policy, such as the effect of the European Central Bank's quantitative easing on sovereign bonds.

Third, the actions of investors impose a self-reinforcing consistency in the way individual elements of the asset class relate to one another. This could be the case, for example, when the bulk of investors use a predominantly top-down approach -- which takes into account the asset class as a whole rather than its individual components -- or when markets are overwhelmed by large tides of capital, be they inflows or outflows.

El-Erian went on to suggest that the first two characteristics were no longer true. That is, emerging markets have changed so greatly they no longer have enough commonalities and are no longer affected by external actions across the board. His conclusion was that one should rethink asset allocation decisions and benchmarking to accommodate for the change in emerging markets as an asset class.

The second article, written by Ben Carlson, reviewed and expanded upon El-Erian’s discussion. Carlson offered up his own criteria for an asset class and then used that framework to analyze emerging markets himself. Carlson writes “Most professional investors benchmark their foreign stock allocation to the MSCI EAFE and then break down their funds or stocks further by region or country. But from an overall asset class perspective, this is still the benchmark the majority of investors choose to follow. I don’t see this changing anytime soon.” He follows this up by saying “A broad, diversified approach is still probably the best option for the majority of investors that don’t have the skillset or expertise to be able to analyze the different emerging market countries.”

In other words, while Carlson acknowledges some changes in emerging markets as an asset class, he doesn’t see any significant changes in the way the investment management industry operates anytime soon.

The final source of information discussing the changes in emerging markets was the April issue of The Bank Credit Analyst publication. Their analysis indicated that there are large differences between emerging market countries on a GDP per capita basis; however, those countries still tend to have correlations close to one, particularly when a bear market occurs.

Stepping back for a second, I think that multiple sources discussing emerging markets as an asset class is informative in itself. The global economy is changing and will continue to change. It would be a mistake to assume that the current circumstances will carry forward indefinitely. The BCA issue noted that emerging markets are now more than 50% of global GDP on a purchasing power parity basis, as illustrated in chart 1:

Chart 1, Shares of GDP

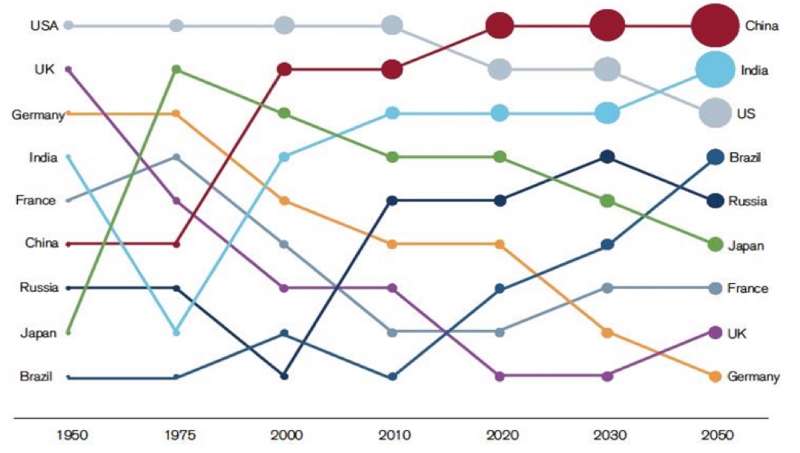

The Charles Darwin quote “It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change” is one of my favorites, both personally and professionally. As a young financial planner, it is important to be open to new ways of thinking because the industry will change. Financial professionals cannot assume the current landscape will always remain as is. As discussed in this blog before, financial planning and investing consists of making assumptions. These assumptions will change, and asset class assumptions are one of them. As countries rise and fall, the general categories of developed and emerging markets will change too. For example, the United States was considered an emerging market not that long ago; however, this is nearly inconceivable now. Point being, a young financial planner will likely be a professional for another 40 years. Think back to 1975 - how has investing and the geopolitical landscape in general changed since then? (see chart 2 below) Keep in mind it will continue to change. How will the state of affairs look in 2055? I would venture emerging markets will be very different to say the least.

Chart 2, Developed and Emerging Market GDPs, 1950-2050

Sources:

http://www.bloombergview.com/articles/2015-04-03/el-erian-rethinking-the-emerging-markets-asset-class

http://awealthofcommonsense.com/are-emerging-markets-still-an-asset-class/

BCA Research

https://blog.wealthfront.com/emerging-markets/BCA Research