When you are in college things are stressful, time-consuming, and confusing. College is when most are given their first opportunity to develop serious systems for learning, retaining information, and building routines that will allow them to excel in real world situations and get the recognition they deserve.

What isn’t challenging, assuming you have a pretty good idea of what you want to do, is actually creating the tasks, exercises, and road map that will manifest into an environment in which you will be primed for growth. That is what college is for. Classes are designed for the profession you desire to enter, and professors coach you on where to spend your time academically to best position yourself for the workforce. Additionally, peers on the same trajectory conveniently serve as motivational and accountability systems.

In the Financial Planning world, the road map for a college student is relatively well laid out: Major in either some type of finance or accounting; Financial Planning if you desire to get the educational requirement for the CERTIFIED FINANCIAL PLANNER™ designation, and then begin your job search. The Financial Planning world is still small enough that if you make it a pure play, professors and other services, such as Caleb Brown’s New Planner Recruiting, can provide assistance by introducing you to firms all over the country.

Once you find the right firm, the next step is also fairly straightforward: sit for the CFP® examination. A terrific amount of money and energy have been put into study programs and review courses specifically tailored to helping you pass this exam. Due to the fact you have made Financial Planning, a specific field, your passion and focus, this will most likely not be a problem for you. You will pass, eventually gain your 2-3 years of work experience, and then be a full-fledged Financial Planner. Congratulations.

None of this is a secret.

I am going to talk about all of the other proficiency areas required to be the best Financial Planners we can be.

I will begin by saying that I obsess about the future. It’s why I was born for this profession. Taking advantage of “time value of money” is important, but when you use that same logic and apply it across your life you can see there are equal if not more important areas where the advantage of starting early is essential. Stashing away money in a 401(k) so it can consistently be working for your retirement can easily be compared to stashing away time studying in college. Other examples include learning how to make the right amount of eye contact, or practicing the secret power of listening more than you speak. Spending time on all these essential skills now will produce a compounding effect that will make us the best at what we do.

The Four Skills

There are four broad categories that intertwine and build off of each other in the profession of Financial Planning. Every successful Planner I have interacted with has these skills to some degree, often in surplus:

The challenging part is that only the first category can be formally assessed, and therefore is easily measured and tracked. The three remaining categories don’t offer grades, degrees or certificates. There is no exam to measure how much people trust you, or a certificate showing you know how to effectively communicate a complex topic in simple terms.

It is the things that can’t be measured that will set us apart from other professionals. It is the things that can’t be tested that will determine whether or not somebody trusts us enough to let us help them accomplish their life goals.

Technical

Obviously, you need to know your stuff. Technical skills are essentially all the things you learn in undergrad and throughout your CFP® studies. This category is not completed after accomplishing those feats by any means, but it is certainly where you have focused the majority of your energy.

The above graphic almost sounds like a job posting, right? No coincidence there, most firms agree that this is pretty bare bones stuff, which is why it is the first skill on our list and the one you spend the most time on in college and CFP® studies.

I quickly learned that technical skills do not end after the CFP®, and the ability to be resourceful in this profession is far more important than having actual resources. While you are not expected to have every rule and regulation memorized, the ability to quickly track down information is essential. Along the same vein, being able to identify planning opportunities is far more valuable than memorizing the IRC. I work to improve this is by engaging in what I call “technical reading” on a daily basis first thing in the morning. The purpose of this is to build familiarity. If I am asked a question that I do not know the answer to, I want to be sure that it is at least a familiar topic and I know exactly where to track down the data.

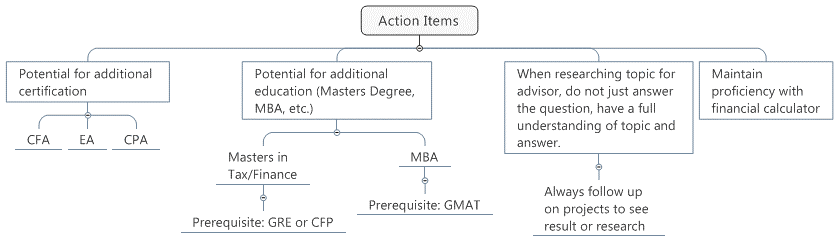

There is the potential for additional certifications, including the CFA, EA, or CPA, or perhaps an additional degree such as a masters in Tax or Financial Planning, or an MBA. While these provide an additional level of differentiation, they naturally require their own separate cost benefit analysis.

When developing a personal plan under the technical umbrella it is important to understand that we cannot be professionals in everything. A huge part of developing this skill is figuring out what area you may want to specialize in.

Communication

“Make it simple, but significant”

-Don Draper

Communication is the ability to get your point across in a clear and concise manner. One of the essential skills we need to have as professionals is the ability to help the client understand the services and advice we provide. This requires attention to speaking, writing, and presentation skills.

Having all the information needed to help a client is not going to be enough if it cannot be delivered effectively.

I have found that doing several things proactively has improved upon this skill. A coworker and I have been conducting educational sessions for the client service staff at our firm. They pick the topics, and we prepare and conduct a presentation. Additionally, I set up a case study group outside of work that holds monthly meetings where we conduct mock advisor-client meetings. This study group provides a safe space where young advisors can practice explaining complicated financial topics with feedback from experienced advisors. If possible, find people in your life that would benefit from a presentation or discussion on financial topics.

Naturally, participation in client meetings has no substitution. Being a participant and contributor in client meetings where a slice of the time is specifically yours will certainly improve communication. This is amplified when a mentor is the other advisor and will provide feedback after the meeting.

Empathy/Relationship Management

As I mentioned earlier, it is the things that can’t be tested or measured that will determine whether individuals will choose to work with us. This category is about the ability to understand different personality types, listening, asking the right questions, resolving conflicts, educating others, and counseling. It is also being cognizant of the feelings of other people so that you can adjust your communication style and approach to connect with them better.

A father with two young children has the financial goal of purchasing a lake house. He feels that he is spending less and less time with his children and that if the family had a summer destination this problem would be resolved. Fairly straightforward, right? However, due to financial constraints that arise from this new goal the father has to work slightly longer hours for the next three years before the family can afford to purchase the lake house. In three years the children are in High School, want to spend even less time with their parents, and their father wasted additional time with them while working towards this tangible financial goal. If the goal was recognized as “I want to spend more time with my family” rather than “I want to buy a Lake House,” that experience could have been lived many times over while the children were still young.

A Note on Self-Compassion:

There will be times where you will need to be the voice of reason for those clients that, for whatever reason, are unable to implement change. Often we see clients trapped in a cycle of guilt or suffering; as advisors we need to practice understanding and remain non-judgmental.

Presence/Marketing/Sales

The final piece of the puzzle is the ability to compel and persuade others using the prior three desirable skills. It’s the ability to sell yourself.

Almost 2,500 years ago Aristotle pointed out the three elements needed to move an audience (rhetoric), these include logos, pathos, and ethos; meaning intellectual, emotional, and charismatic appeal. In the beginning this is mostly just getting in front of people and sharing either advice or information that is relevant to their situation.

The ethos side relates to your credibility. This is where technical and communication skills shine. Demonstrating that you are competent and have the presence to represent that competence will be powerful. This is an industry that demands people of character.

Pathos is the appeal to emotion. Financial Planners must make an emotional connection with the people they service. Discerning the appropriate emotional appeal is of the utmost importance.

Logos, the appeal to reason, is where demonstrating why engaging with you as a professional makes sense. You are in the business of persuading. You must persuade those you interact with to pay you for Financial Planning services, engage in a comprehensive Financial Planning process, and actually implement your recommendations.

Proactively working with friends and peers on their immediate financial needs will provide just as much help to you on the presence and sales side as it will to them on the planning side. While practicing with those close to you is helpful, again, learning through observation will do wonders on watching how these skills and rhetoric are used.

I also would like to stress the importance of mentors. Learning through real-life observation is difficult to replicate, and being a willing mentee, like a sponge, is an admirable desire. Often it is easy to feel like you are asking too many questions, but at the end of the day, this industry is filled with passionate people who love to teach.

How to Start

If you make your goal to run a marathon, every day leading up to the race you will not be accomplishing that goal. This would inevitably kill your motivation (and is supposed to be really bad for your joints). People often see challenges as insurmountable, become discouraged, and give up. However, if you focus on a system or routine rather than the end goal you will consistently have positive reinforcement in your life. For example, if you make the goal to simply run every day, each day you run you have accomplished your goal, whether you ran one mile or 26.2. This mindset creates a very positive attitude towards goal setting.

There is nothing you can do to all of the sudden wake up and be a good communicator or have terrific empathy. But what you can do is make a goal to teach somebody a financial related topic that is relevant to them every week. Or you can make it your goal to get outside of your comfort zone and join a new group that will involve sharing your story and listening to theirs.